How to reconcile your premium tax credit

A tax credit you can use to lower your monthly insurance payment (called your “premium”) when you enroll in a plan through the Health Insurance Marketplace®. Your tax credit is based on the income estimate and household information you put on your Marketplace application.

Refer to glossary for more details.

to lower your monthly payment, you’ll have to “

How you find out if you used the right amount of premium tax credit during the year. To reconcile, you compare two amounts: the premium tax credit you used in advance during the year; and the amount of tax credit you qualify for based on your final income. You’ll use IRS Form 8962 to do this. If you used more premium tax credit than you qualify for, you’ll pay the difference with your federal taxes. If you used less, you’ll get the difference as a credit.

Refer to glossary for more details.

” when you file your federal taxes. This means you’ll compare:

- The amount of the premium tax credit you used during the year. (This was paid directly to your health plan so your monthly payment was lower.)

- The premium tax credit you actually qualify for based on your final income for the year.

Any difference between the two figures will affect your refund or tax owed.

You should get your Form 1095-A in the mail by mid-February. It may be available in your Marketplace account anytime from mid-January to February 1. If you don't get it, or it's incorrect, contact the Marketplace Call Center.

How to reconcile your premium tax credit

- Get your Form 1095-A.

- Print Form 8962 (PDF, 110 KB) and instructions (PDF, 348 KB).

- Use the information from your 1095-A form to complete Part II of Form 8962.

Select the information you need to get details:

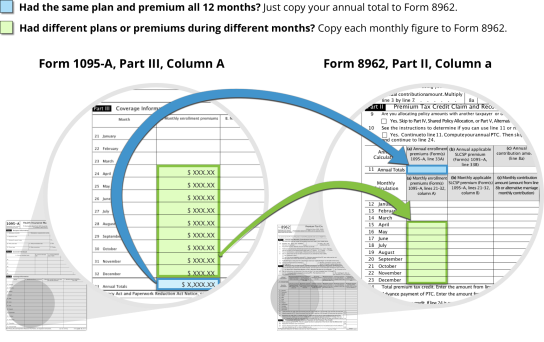

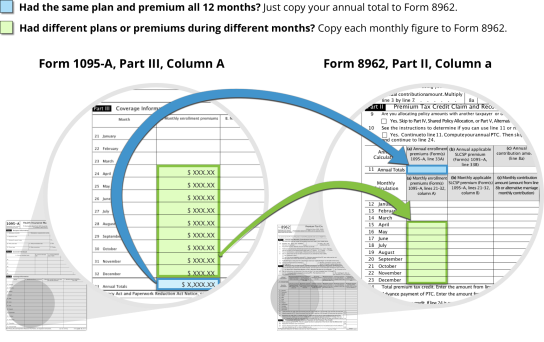

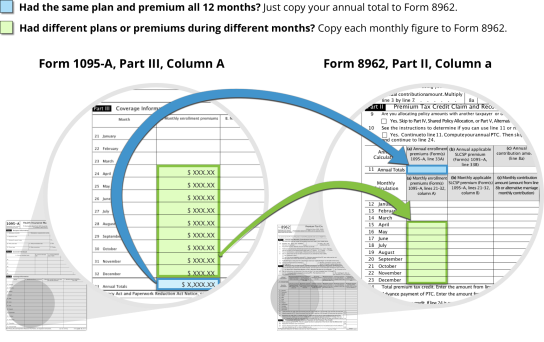

Enrollment Premiums

Where to find it on Form 1095-A: Part III: Column A

- Annual amount: Line 33

- Monthly amounts: Lines 21 - 32

Where to enter it on Form 8962: Part II: Column a

- Annual amount: Line 11

- Monthly amounts: Lines 12 - 23

How to move enrollment premium info to Form 8962

figure to Form 8962." />

figure to Form 8962." />

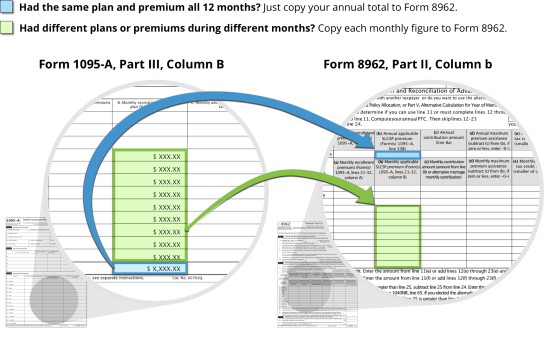

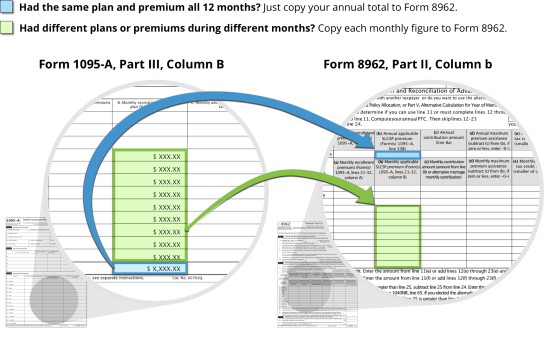

Second lowest cost Silver plan (SLCSP) premium

Where to find it on Form 1095-A: Part III: Column B

- Annual amount: Line 33

- Monthly amounts: Lines 21-32

Where to enter it on Form 8962: Part II: Column b

- Annual amount: Line 11

- Monthly amounts: Lines 21-23

How to move second lowest cost Silver plan (SLCSP) premium info to Form 8962

figure to Form 8962." />

figure to Form 8962." />

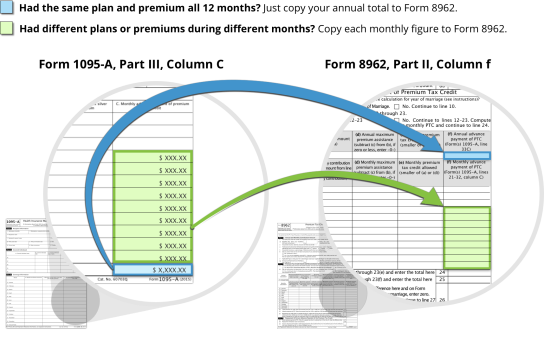

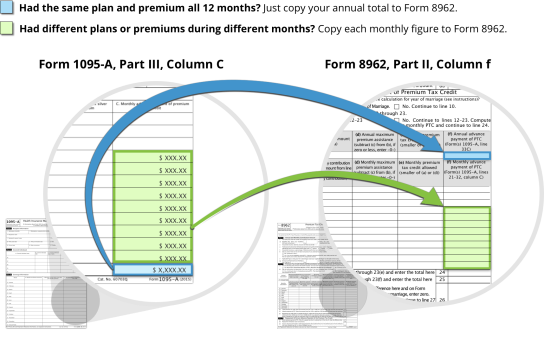

Advance payment of premium tax credit

Where to find it on Form 1095-A: Part III: Column C

- Annual amount: Line 33

- Monthly amounts: Lines 21-32

Where to enter it on Form 8962: Part II: Column f

- Annual amount: Line 11

- Monthly amounts: Lines 21-23

How to move advance payment of premium tax credit info to Form 8962

figure to Form 8962." />

figure to Form 8962." />

- Complete all sections of Form 8962. On Line 26, you’ll find out if you used more or less premium tax credit than you qualify for based on your final 2023 income. This will affect the amount of your refund or tax due.

- Include your completed Form 8962 with your 2023 federal tax return.

What happens if you don’t reconcile your taxes

If you had a 2023 Marketplace plan but didn’t file and reconcile your 2022 taxes, you may lose any savings you’re getting for your 2024 plan.

- You’ll get a letter from the Marketplace with details about what you need to do.

- You may also get “Letter 12C” from the IRS.

If you haven’t filed your 2023 tax return — or filed a return but didn’t reconcile the premium tax credit for all household members — you must do so immediately.

If you confirm that you filed your 2022 tax return, you won’t need to do anything else.

More on 2022 taxes

- Get more tax filing information.

- Learn more about your health coverage and federal taxes.

- Confirm your tax filing status for 2022 using theInteractive Tax Assistantfrom the IRS.

figure to Form 8962." />

figure to Form 8962." /> figure to Form 8962." />

figure to Form 8962." /> figure to Form 8962." />

figure to Form 8962." /> figure to Form 8962." />

figure to Form 8962." />