Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first module of each course. Start Free

The Smoot-Hawley Tariff Act raised around 900 import tariffs by an average of 40% to 60%. Also referred to as the United States Tariff Act of 1930, its purpose was to safeguard U.S. businesses and farmers. Rather, it added extensive stress to the Great Depression . The law got its name from its chief supporters, Representative Willis Hawley of Oregon and Senator Reed Smoot of Utah.

In June 1930, the Smoot-Hawley Tariff Act increased U.S. tariffs on agricultural imports and more than 20,000 imported goods. The tariffs imposed were the second-highest in American history. The goal was to protect American farmers who were most affected by the Great Depression. However, it raised the prices of food and other items.

Other countries retaliated with their respective tariff hikes, forcing global trade to decline by 65%. Economists believe that the Smoot–Hawley Tariff Act was one of the principal causes of the economic depression. The legislation highlighted how dangerous protectionist trade policies are for the world economy. Afterward, most countries promoted free trade agreements that support fair trade for all.

During the time of the Great Depression, farmers made up around 20% of the U.S. population. Food prices skyrocketed between 1915 and 1918 as countries emerged from World War I. In the 1920s, as European farmers were recovering from the war, American farmers met harsh competition and falling prices due to overproduction. As a result, American agricultural bodies pushed the government to safeguard against agricultural goods and imports.

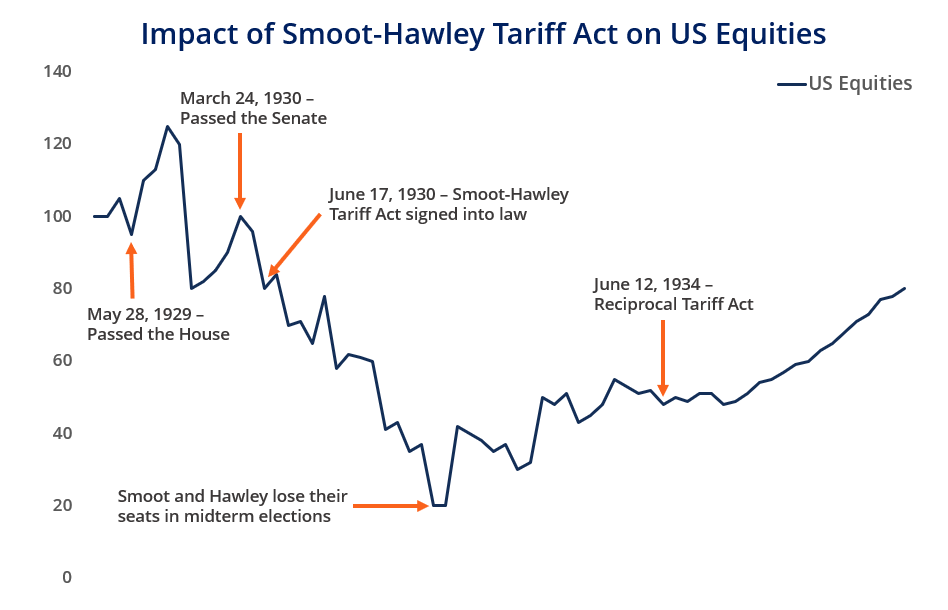

During the 1928 U.S. presidential campaign, Herbert Hoover vowed to raise prices on agricultural imports. However, as soon he took office, representatives from other sectors asked him to increase tariffs on other imported goods. The bill came into law on June 17, 1930.

The law raised the tariff by approximately 20%, prompting other countries to impose high tariffs on U.S. exports as retaliation. It led to U.S. exports falling from $7 billion in 1929 to $2.5 billion in 1932. Farm exports were down by one-third from their 1929 levels by 1933. International trade plummeted 65%.

In 1934, President Roosevelt signed the Reciprocal Trade Agreements Act, which reduced tariffs and supported trade independence and collaboration across countries. Some historians believe that the tariff hike deepened the Great Depression, which might have incited the rise of political extremism and extremist leaders.

On May 28, 1929, the Smoot-Hawley bill cleared the U.S. House of Representatives. On March 24, 1930, it passed the Senate, triggering a fall in stock prices. On June 17, 1930, President Herbert Hoover signed the bill into law, further plummeting the stock market.

Foreigners started withdrawing capital from the stock market. Millions of investors incurred heavy losses when the market crashed. Soon, imports became overly expensive, making it tougher for the jobless to buy anything other than domestic goods.

The legislation did the most harm by souring trade relations with other countries. The League of Nations, of which the U.S. was not part, previously talked of a tariff treaty. However, the Smoot-Hawley Tariff Act helped undermine that idea.

By September 1929, the Hoover administration experienced protests from 23 trading partners following news of the higher tariffs. However, the U.S. ignored the retaliation threat. As a result, Canada, the U.S.’ largest trading partner, imposed extra duties on some American goods and cut tariffs on imports from the rest of the British Empire.

Within two years, several countries adopted similar retaliatory duties. It led to the worsening of an already struggling world economy and reducing global trade. U.S. imports and exports with Europe fell by two-thirds between 1929 and 1932.

Global trade declined at a similar rate in the four years the legislation was in effect, making it harder for the United States to pull itself out of its economic difficulties.

The drastic effects of the Smoot-Hawley Tariff Act influenced the long-term trade policies. At the start of the Reciprocal Trade Agreements Act of 1934, the U.S. began to negotiate exclusive trade policies with countries.

Over the following decades, the U.S. encouraged international trade by taking a lead role in the General Agreement on Tariffs and Trade (GATT), the North American Free Trade Agreement (NAFTA), and the World Trade Organization (WTO).

Today’s world economy is dependent on one another. The Smoot-Hawley Act showed that trade protectionism practices could severely affect one’s economy and the global economy. Being the economic epicenter, the U.S. is accountable for putting together policies that are fair for all.

CFI is the official provider of the global Capital Markets & Securities Analyst (CMSA®) certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional resources below will be useful:

From equities, fixed income to derivatives, the CMSA certification bridges the gap from where you are now to where you want to be — a world-class capital markets analyst.